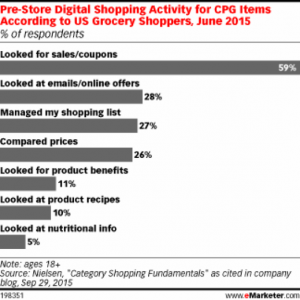

A recent report from Nielsen revealed, somewhat unsurprisingly, that discounts, coupons, and other promotions have a significant effect on the choices grocery shoppers make about their CPG purchases. In fact, the report revealed that nearly six in ten consumers look for sales or coupons online before going shopping.

Consumers’ propensity to search for deals online was even greater than their desire to compare prices. The report showed that when shoppers find a deal related to the category they’re looking for, it will often impact which brand they ultimately purchase—regardless of price!

Consumers’ propensity to search for deals online was even greater than their desire to compare prices. The report showed that when shoppers find a deal related to the category they’re looking for, it will often impact which brand they ultimately purchase—regardless of price!

What does this mean for consumer goods marketers? For years, CPG promotions have been based on the underlying belief that shoppers make decisions on price alone, e.g., they’re cool-headed, rational actors trying to maximize their “utility.” We now know the picture is far more complex.

Thanks to pioneering work of behavioral economists such as Daniel Kahneman, most marketers today understand that consumers’ decision-making processes are more often based on a more nuanced set of subconscious ques; social, emotional, and cognitive heuristics or “rules of thumb” that subtly influence the final purchase (usually without the express knowledge of the shopper). Notably, these outcomes are often counterintuitive to the principles of traditional economics.

The growing popularity of online coupons, and their apparent influence on in-store buying decisions, presents both a challenge and an opportunity for consumer goods marketers looking for new ways to engage consumers. While it adds a new level of complexity, it also means that digital offers can be leveraged to intelligently inform other CPG/retail marketing efforts, including trade promotions. In fact, digital coupons and in-store promotions no longer constitute two disparate promotional channels; they’re now part of a single, cohesive buyer’s journey. The upshot is that one can be used to not only influence, but also to predict the other.

Given the apparent need to think beyond price when developing offers, this is of particular importance. If driving trial or volume sales isn’t just about discounting deeper, how can marketers know which offers will be most effective in store? If slight differences in offer structure, such as “Buy One, Get One 50% Off” vs. “Get 25% Off of One”, can lead to a massive difference in consumer response, is looking at past performance enough? The answer is no. If you’ve never before tried a “BOGO 50% Off” offer, no amount of statistical regression will tell you how it will perform in the real world; it’s simply not in your data.

Historically, getting to the truth has meant running expensive in-store pilots. This approach took months to execute and typically only allowed you to test a few offer variations at a time. It was also difficult to control for external noise at each retail location, such as competitor activity, weather, execution, seasonality, etc.

So, what can consumer goods marketers do to keep pace given the major industry trends unfolding under their feet?

Similar to e-commerce players like Amazon, several brick-and-mortar retailers and leading brands are now running structured tests through digital platforms, including online coupons and photo rebate offers which have recently exploded in popularity. Shoppers “clip” digital offers they find most compelling online and redeem them in store, all as part of their regular shopping routines. Engagement with various test offers is measured in real time and used to inform future in-store trade promotions.

This “digital experimentation” approach lets marketers try out numerous new promotions, with the ability to go far beyond the simple price-based offers that the industry has come to rely on. By letting consumers choose, they can precisely measure which promotions will work best in the real world (rather than guessing based on what worked in the past). Most importantly, this is all done before investing limited trade funds!